yakettyyak

Archive for

What is the Difference Between Fiscal and Monetary? And Why Should I Care?

In the news, we have been hearing a lot about fiscal policy and monetary policy. It’s been said by many that the problem is that the US can’t get its “fiscal house” in order.

In the news, we have been hearing a lot about fiscal policy and monetary policy. It’s been said by many that the problem is that the US can’t get its “fiscal house” in order.

Others say that the Federal Reserve’s “monetary policy” is hurting rather than helping the economy.

So, how are they different?

The term fiscal refers to revenue and spending. Basically, when you see that in the news, you will usually see Congress associated with it. In local news, you will see city councils or state legislatures mentioned. In all three levels (national, state and local), the power to spend is always given to the houses (or House, in the case of Nebraska).

The reason for this is that the founding fathers, with their fear of having a president that was too powerful, gave the right to tax and spend to Congress. This way, whatever the President might want to do, only Congress could give him the money to do it.

So, when you read about anything “fiscal”, think of taxes and spending. The President and Congress will have arguments over it.

To frame it in today’s context, the big argument overall is the use of tax money (fiscal policy) during a weak economy. Republicans do not believe any tax money should be spent to create jobs; no stimulus. Democrats believe the government is obligated to spend tax money to create jobs.

What difference does it make to you? This is a question of personal belief. Do you believe the government should spend money to create jobs during hard times? Or do you think businesses will hire people and the government should stay out of it?

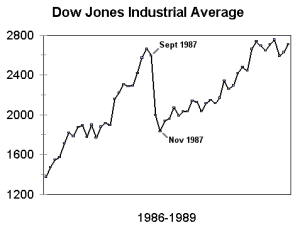

Monetary, on the other hand, refers to the supply of money in circulation. The chart above gives an idea of what that looks like.

Based on the law of supply and demand, the more scarce a thing is, the more expensive it becomes. The Federal Reserve has the power to regulate the amount of money in circulation in the United States. If the Fed thinks there is too much money in circulation, it can do a couple of things: raise interest rates or sell Treasury Bills.

Raising interest rates makes it harder for people and companies to get credit. When that happens, people slow down their buying and companies slow down their production. In effect, there is less money in circulation so it is more expensive to borrow.

Lowering interest rates has the opposite effect: people spend more and companies tend to increase production because, well, people are buying more. There is more money in circulation so it is cheap to borrow.

What difference does it make to me? Monetary policy affects things like your credit card interest rates or your car or home loan if you have an adjustable rate mortgage.

Monetary policy is also used to stem inflation. If prices start getting higher, it means there is too much money around so it isn’t worth as much, say, television set. The Fed will usually raise interest rates to make it harder to get money. Also, at higher interest rates, investors will buy more Treasury Bills which also takes money out of circulation and locks them up for different periods of time.

If I got something wrong or you have any questions, post a comment with it.

Business Growth Does Not Mean More Jobs

This article published in The Economist in part validates the recent post about whether or not cutting taxes will improve hiring. Basically, this chart says that, even when businesses are doing well, as they have been over the past couple of years, they are not hiring.

Should be believe that cutting taxes (allowing the businesses to increase profits) will encourage them to hire?

Can Tax Cuts Create Jobs?

Before answering the question in the title of this post, let’s define a tax cut. Tax cuts are the lowering of the rate of taxation for a group whether it is people of a certain income, purchasers of gasoline or businesses.

Before answering the question in the title of this post, let’s define a tax cut. Tax cuts are the lowering of the rate of taxation for a group whether it is people of a certain income, purchasers of gasoline or businesses.

A 1% tax cut just means that, if the tax was originally, say, 6%, it would be dropped to 5%. Simple enough.

Now to the question of whether tax cuts can create jobs. Let’s answer that by taking looking first at jobs. Jobs are engagements that people have to do or make something and get paid for doing or making it. These things are usually done or made because the employer can sell it and make a profit.

Taking an example, let’s look at a small coffee shop in a neighborhood. The owner hires people to man the counter and keep the store running. The owners find that, on average, they can expect 500 customers daily and their staff of 8 can handle that perfectly and they turn a profit.

Now, let’s say the coffee shop’s tax rate is 25% and with that and all the other expenses, the owner makes an income for himself of $100,000.

Tomorrow, the government introduces a 10% tax cut for businesses.

The owner now has a choice to make: he can increase his income by $20,000 or hire an additional staff member to serve coffee. Which would he do?

Considering the store is adequately staffed to handle the business that comes in, he would probably take the extra pay and put it away in his child’s college fund.

The only way he would hire another staffer is if his business picked up.

So, take this example and apply it to Starbucks Coffee, McDonald’s, WalMart or any other business. Are they going to automatically hire more people because they receive a tax cut and not because they have more work (more customers)?

Today we have high unemployment which means less people have money to buy things. This means that Starbucks and McDonald’s probably have less customers. So, they probably don’t need to hire more people.

Therefore, a tax cut for businesses probably won’t get them to hire more people. But it will probably add to profit and make the stock take off.

Coincidentally, if you follow the stock market, it has been up the last two years while we have been in a recession. I think we know the reason why.

How important is it for you to follow the stock market?

If you listen to the news on the radio or watch it on TV, you will always hear about the Dow Jones Industrial Average (DJIA) going up or down on a particular day. What does that mean?

The DJIA is an index which means that it is an attempt to put together a portfolio of stocks that reflects the stock market as a whole. There are other indices like the Russell 2000 and the S&P 500.

Why do we need indices? Well, think of it as being like a big pot of soup. In order to decide whether or not we need to add more salt, we dip in a spoon and taste it. But how do we know the place we dipped the spoon in tastes like the rest of the pot? We pretty much know this because all the ingredients in the soup are represented to some extent in the spoon. That’s what an index tries to do.

So, why should the  average person care about the DJIA (or any index)? The average person in the US probably shouldn’t worry about it too much. For one, as we’ve seen over the past couple of years, it is possible for the DJIA to soar while many people are unemployed. It is simply an indication of the health of public companies trading stock.

average person care about the DJIA (or any index)? The average person in the US probably shouldn’t worry about it too much. For one, as we’ve seen over the past couple of years, it is possible for the DJIA to soar while many people are unemployed. It is simply an indication of the health of public companies trading stock.

So, let’s assume you have index funds in your 401K (these funds mirror one index or another). How much does it matter to you? It matters in that your money is in the market and it grows (or declines) as the market does. However, before obsessing over it, think about the amount you have.

If you have $5,000 in your index fund and the DJIA goes up by 1%, you made $50 on paper.

If you have $50 million in an index fund and the DJIA goes up by 1%, you made $500,000 on paper.

How important is it for you to follow the DJIA?

Do Unions Hurt Small Businesses?

Mitt Romney put out a video in which a small business owner relates his story of how a union bullied his company because his employees didn’t want to organize. Here it is:

This video raises some questions:

- Are unions better for employees of large businesses rather than small businesses?

- Do unions today help employees in any business?

- Do employees really need collective bargaining? Does it benefit them?

- Perhaps most importantly: Is it possible to align management and labor interests?

Saving the Economy (Part 1)

In the September 11, 2011 edition of the New York Times, there is an opinion piece by Harvard University professor Robert Barro titled “How to Really Save the Economy”. In it, he describes “six big steps” that will, well, save the economy. We’ll look at one a day over the coming week.

Dr. Barro’s first step is “reforming Social Security and Medicare by increasing ages of eligibility”.

Let’s say we raise the ages of eligibility for both Social Security and Medicare to 70. Financial impacts aside, doing this would effectively mean that the retirement age would de facto become 70 years of age. Which means more of people would in the “working age” pool of those eligible to be employed.

At a time when we have high unemployment (meaning more people eligible to work than there are jobs), should we increase the number of eligible workers?

You must be logged in to post a comment.