yakettyyak

yakettyyak

A Successful Conservative Tactic

Yesterday was a particularly interesting day. A few interesting exchanges took place between outgoing Secretary of State Hilary Clinton and various Republican Senators, for example.

Yesterday was a particularly interesting day. A few interesting exchanges took place between outgoing Secretary of State Hilary Clinton and various Republican Senators, for example.

Another interesting event was the Republicans’ call for a budget to be passed and, while we’re on the subject, the postponement of the raising of the debt ceiling. In case you haven’t heard, it’s called the “No Budget; No Pay” act and it was passed by the House. The gist of it is that, unless a budget is approved by both houses of Congress, its members will have their pay withheld until one passes.

Keep in mind that the US has not had a budget resolution passed in four years. Also note that budget resolutions are non-binding and are basically recommended guidelines that may or may not reflect reality.

The link between these two events yesterday is that both were designed to sound good while having little substance behind them. In other words, they are an opiate of the masses: actions that will get publicized, are easy to remember, and sound like legislators are active and on top of things.

Now, before moving forward, it must be said that these two events were engineered by members of the GOP and, as far as their goals are concerned, they went one for two.

The lambasting of Mrs. Clinton by the Senate committee backfired a bit. She was not deferential to its members. As seen and heard in the largely publicized clips of her testimony, she accepted responsibility where the facts supported it and rejected efforts to paint her as disengaged during the crisis in Benghazi. The message they wanted to get out was that the administration was incompetent in handling this event. Senator Rand Paul (R-Kentucky) at one point called it “the worst tragedy since 9/11” and that, had he been president at the time, he would have relieved her of her post. In other words, “You didn’t do your job and you should have been fired”.

The message that did get out from her testimony is that the GOP is not clear on facts and is more interested in pointing fingers than in understanding what happened and the lessons to be learned.

In the case of the debt ceiling ordeal, the message was that “if we can’t do our jobs, we should not be paid”. They succeeded on that front and, to the average American, it sounds like a good idea. After all, those of us who go to work every day do not expect to get paid if we don’t do our jobs. If we don’t do our jobs, we get fired.

The Tactic

These were implementations of a Republican tactic that is especially effective with the general public:

- Create a mountain from a molehill: Benghazi (a tragedy but low on US priorities), debt ceiling (has been raised routinely with no questions in prior administrations).

- Link it to an emotionally charged issue: 9/11, the national debt.

- Propose solutions that are not solutions but sound like tough measures (Senate hearings that result in no action; delay raising the debt ceiling and put Congressional paychecks on the line).

- Go home and tell constituents you are fighting the good fight for them and the country.

This tactic has been used very effectively in many cases. A couple of recent examples are:

- The gun control debate: “The government wants to take your guns away. It’s against the 2nd Amendment. We should put armed guards in every school. I am fighting to keep them from confiscating your guns and trampling on the Constitution.”

- The gay marriage debate: “People should not be allowed to marry because they are gay. The Constitution says marriage is between one man and one woman. We can recognize civil unions for legal purposes. I am fighting to preserve marriage as defined in the Constitution.” (Marriage is not mentioned in the Constitution at all.)

You get the idea.

So, why can’t Liberals/Progressives/Democrats use the same tactics? Looking at arguments rationally takes time and thought. These are not particularly appetizing to the current environment. Everything is neatly packaged for quick consumption. It takes time and thought to read the labels and make a choice.

We live in good times, though. Better times are probably ahead on the social, political and economic perspectives. The US has elected a Democrat twice in a row to the Presidency by a historically large margin.

But do not expect the conservative side of the equation to take this lying down. If there is one thing the Administration should be prepared for, it is the application of the tactic outlined here directly against the President. It happened with President Clinton in the second term (Monica Lewinsky and impeachment). They will probably try it again.

One Step Beyond…the Fiscal Cliff

We are up against the edge of the “fiscal cliff” as I write this and I think a couple of things are apparent. First, this whole automatic tax increase/budget cut idea was silly.

We are up against the edge of the “fiscal cliff” as I write this and I think a couple of things are apparent. First, this whole automatic tax increase/budget cut idea was silly.

Really, thinking people do not believe that anything “automatic” like the current budget rule can work in something as massive and real as an economy. Especially, the world’s largest economy. This, I believe was the result of too many members of Congress getting together and thinking that a hard and fast rule like this made for good campaign strategy.

What politician would not like to say he/she is “fiscally conservative” and strong against deficits by signing on to something absolutist like this?

The bottom line is that the world does not work that way. But, apparently, the US government does. Is this really the only type of measure that can motivate the executive and legislative branches to do their jobs?

The second thing about this is that we really need to look at what is being discussed here. Very simplistically, it is the interests of those making above $250,000 per year against the interests of those who make less than that.

Yes, there is more to it. Most on one side want to get rid of Social Security, Medicaid and other safety nets. Most on the other side believe that government can be a constructive and beneficial player in our society.

When you get right down to it, though, it’s pretty simple.

It will be interesting to see what the compromise they come up with looks like. It will be more interesting to see the public’s reaction during the mid-term elections.

Another Day; Another Shooter

I just learned about a mass shooting at a school in Connecticut.

I just learned about a mass shooting at a school in Connecticut.

Coincidentally, two days ago, I was debating gun control on Facebook. The spark to that thread was another shooting at an Oregon mall that happened earlier in the week.

The thread was as you’d expect. Those of us on the left think we’d be better off with increased gun control. Those on the right side of the fence believe we have the right to own as many guns as we want and that increased gun ownership reduces the amount of murders by guns.

I can kind of follow the logic of more guns bringing down the incidents of murder by guns. However, I can’t subscribe to it. The reason is simple: We are human. We get passionate and we get emotional. There is nothing wrong with that but it means that, at times, we are not thinking clearly or rationally about

The result is that we do things that we and others regret. Personal freedom doesn’t only mean that we have the freedom to do whatever we want. It means that we can do what we want within constraints set bu laws, society, whatever. One of those constraints, in the US and many countries is that our actions should not infringe on the rights of others.

But these kids and teachers were killed because, at a very fundamental level, the shooter was exercising his right to have weapons. Because of this right, we have arms available at the local Walmart.

“Guns don’t kill people; people kill people.”

True. However, guns allow people to kill efficiently: quickly and en mass. There was never a mass killing by sword, for example. Even if someone were to attempt it, you could probably keep the guy at bay with some rocks or whatever projectile was handy. You can’t really do that against a gun. You really need another gun to go up against that.

“If more people were armed, they could stop the shooter.”

I don’t know that, in a crowded school or mall, I want ten people shooting at one person. I mean, in a high stress situation like that, are they going to be able to correctly identify the bad guy if they all have guns? Also, there is the risk that three out of the ten (my guess) can’t shoot straight and might hit an innocent person.

Realistically

Realistically, trying to ban guns would be like trying to ban drugs or alcohol. But I am an optimist. I think that we can shape policies and laws that effectively limit the availability of firearms. In fact, I know we can do this.

However, there are many who don’t believe there should be any limit and, given our history, I don’t foresee any meaningful change in policy or laws in the near future. Part of the reason is that we have many interest groups who, rightly or wrongly, would be against additional limits.

The other part of the reason is that we have the second amendment to the Constitution. We adhere to it and we defend that right which was written in 1791 when we lived in a largely agrarian society and most of us hunted for food.

Do What Makes Sense

We might want to consider using the Constitution’s ability to be amended to adjust that right for these times.

It is time we started looking at doing what makes sense and not blindly going down a path simply because it was laid out 200 years ago. The Founding Fathers were very intelligent men. They were intelligent enough to provide for amendments because they understood that they could not predict the future. They understood that, however smart they were, future generations would be increasingly smarter.

Let’s exercise our greater intelligence to do something that makes sense.

Those people, especially the kids, did not have to die this week.

What do you think?

False Logic: Red vs. Blue Inequality

In today’s column, The Wrong Inequality – NYTimes.com, David Brooks says there are two types of inequality:

In today’s column, The Wrong Inequality – NYTimes.com, David Brooks says there are two types of inequality:

- Blue – which is the inequality that has been in the news lately and exemplified by the Occupy Wall Street (OWS) movement. He says this is the inequality experienced in places like New York, San Francisco, Chicago and Los Angeles…basically, major metropolitan areas. In this case, inequality refers to the difference between the top 1% and the bottom 99%.

- Red – which is the inequality experienced in small towns like Scranton and others like it. In this case, the inequality experienced is “between those with a college degree and those without.”

In the Red case, Mr. Brooks further explains that the inequalities of family structure, child rearing patterns and educational attainment.” This, he says, is the more important inequality and that it should be getting more attention than the Blue type.

To improve this type of inequality, he says, we should be focused on “the nation’s stagnant human capital, its stagnant social mobility and the disorganized social fabric for the bottom 50 percent.” We should be trying to improve it.

Here is where this logic is false. First, the reason that this Red inequality exists to such an extent is largely because of policies enacted to created this gap. Policies that, in practice, say that government cannot solve any of the nation’s problems. These policies also say that, if we leave the problems to the free market and private enterprise, charitable giving will take care of the social problems.

Mr. Brooks, in saying that we need to take care of this Red inequality, is saying that we need more social stability and opportunity. However, as a conservative, he is probably also thinking that charities and the private sector should be the ones to do something about it.

Second, Mr. Brooks does not make a causal connection between the Blue and the Red inequalities when, in fact, there is a glaring relationship. The Blue-type inequality is a direct (but not sole) contributor to the Red. Today, we live in an age where the Supreme Court has ruled that corporations are people and that spending money is a form of free speech.

It follows that the more you are able to spend, the louder your voice. Very few of us (none in the bottom 99%) have the wealth or disposable income of a corporation. If your are running for state or federal office today, you have no chance of succeeding without the monetary support of corporations. In fact, the corporation is the citizen group you most depend on.

In a way, I agree with Mr. Brooks column. The Red inequality is a major problem and one that must be addressed. But it cannot be successfully addressed without doing something about the Blue inequality first. To be clever, one might say the underlying issue is green.

What is the Difference Between Fiscal and Monetary? And Why Should I Care?

In the news, we have been hearing a lot about fiscal policy and monetary policy. It’s been said by many that the problem is that the US can’t get its “fiscal house” in order.

In the news, we have been hearing a lot about fiscal policy and monetary policy. It’s been said by many that the problem is that the US can’t get its “fiscal house” in order.

Others say that the Federal Reserve’s “monetary policy” is hurting rather than helping the economy.

So, how are they different?

The term fiscal refers to revenue and spending. Basically, when you see that in the news, you will usually see Congress associated with it. In local news, you will see city councils or state legislatures mentioned. In all three levels (national, state and local), the power to spend is always given to the houses (or House, in the case of Nebraska).

The reason for this is that the founding fathers, with their fear of having a president that was too powerful, gave the right to tax and spend to Congress. This way, whatever the President might want to do, only Congress could give him the money to do it.

So, when you read about anything “fiscal”, think of taxes and spending. The President and Congress will have arguments over it.

To frame it in today’s context, the big argument overall is the use of tax money (fiscal policy) during a weak economy. Republicans do not believe any tax money should be spent to create jobs; no stimulus. Democrats believe the government is obligated to spend tax money to create jobs.

What difference does it make to you? This is a question of personal belief. Do you believe the government should spend money to create jobs during hard times? Or do you think businesses will hire people and the government should stay out of it?

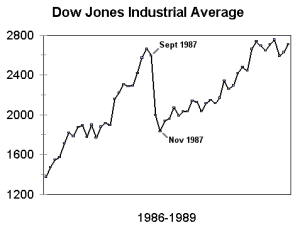

Monetary, on the other hand, refers to the supply of money in circulation. The chart above gives an idea of what that looks like.

Based on the law of supply and demand, the more scarce a thing is, the more expensive it becomes. The Federal Reserve has the power to regulate the amount of money in circulation in the United States. If the Fed thinks there is too much money in circulation, it can do a couple of things: raise interest rates or sell Treasury Bills.

Raising interest rates makes it harder for people and companies to get credit. When that happens, people slow down their buying and companies slow down their production. In effect, there is less money in circulation so it is more expensive to borrow.

Lowering interest rates has the opposite effect: people spend more and companies tend to increase production because, well, people are buying more. There is more money in circulation so it is cheap to borrow.

What difference does it make to me? Monetary policy affects things like your credit card interest rates or your car or home loan if you have an adjustable rate mortgage.

Monetary policy is also used to stem inflation. If prices start getting higher, it means there is too much money around so it isn’t worth as much, say, television set. The Fed will usually raise interest rates to make it harder to get money. Also, at higher interest rates, investors will buy more Treasury Bills which also takes money out of circulation and locks them up for different periods of time.

If I got something wrong or you have any questions, post a comment with it.

Business Growth Does Not Mean More Jobs

This article published in The Economist in part validates the recent post about whether or not cutting taxes will improve hiring. Basically, this chart says that, even when businesses are doing well, as they have been over the past couple of years, they are not hiring.

Should be believe that cutting taxes (allowing the businesses to increase profits) will encourage them to hire?

Can Tax Cuts Create Jobs?

Before answering the question in the title of this post, let’s define a tax cut. Tax cuts are the lowering of the rate of taxation for a group whether it is people of a certain income, purchasers of gasoline or businesses.

Before answering the question in the title of this post, let’s define a tax cut. Tax cuts are the lowering of the rate of taxation for a group whether it is people of a certain income, purchasers of gasoline or businesses.

A 1% tax cut just means that, if the tax was originally, say, 6%, it would be dropped to 5%. Simple enough.

Now to the question of whether tax cuts can create jobs. Let’s answer that by taking looking first at jobs. Jobs are engagements that people have to do or make something and get paid for doing or making it. These things are usually done or made because the employer can sell it and make a profit.

Taking an example, let’s look at a small coffee shop in a neighborhood. The owner hires people to man the counter and keep the store running. The owners find that, on average, they can expect 500 customers daily and their staff of 8 can handle that perfectly and they turn a profit.

Now, let’s say the coffee shop’s tax rate is 25% and with that and all the other expenses, the owner makes an income for himself of $100,000.

Tomorrow, the government introduces a 10% tax cut for businesses.

The owner now has a choice to make: he can increase his income by $20,000 or hire an additional staff member to serve coffee. Which would he do?

Considering the store is adequately staffed to handle the business that comes in, he would probably take the extra pay and put it away in his child’s college fund.

The only way he would hire another staffer is if his business picked up.

So, take this example and apply it to Starbucks Coffee, McDonald’s, WalMart or any other business. Are they going to automatically hire more people because they receive a tax cut and not because they have more work (more customers)?

Today we have high unemployment which means less people have money to buy things. This means that Starbucks and McDonald’s probably have less customers. So, they probably don’t need to hire more people.

Therefore, a tax cut for businesses probably won’t get them to hire more people. But it will probably add to profit and make the stock take off.

Coincidentally, if you follow the stock market, it has been up the last two years while we have been in a recession. I think we know the reason why.

How important is it for you to follow the stock market?

If you listen to the news on the radio or watch it on TV, you will always hear about the Dow Jones Industrial Average (DJIA) going up or down on a particular day. What does that mean?

The DJIA is an index which means that it is an attempt to put together a portfolio of stocks that reflects the stock market as a whole. There are other indices like the Russell 2000 and the S&P 500.

Why do we need indices? Well, think of it as being like a big pot of soup. In order to decide whether or not we need to add more salt, we dip in a spoon and taste it. But how do we know the place we dipped the spoon in tastes like the rest of the pot? We pretty much know this because all the ingredients in the soup are represented to some extent in the spoon. That’s what an index tries to do.

So, why should the  average person care about the DJIA (or any index)? The average person in the US probably shouldn’t worry about it too much. For one, as we’ve seen over the past couple of years, it is possible for the DJIA to soar while many people are unemployed. It is simply an indication of the health of public companies trading stock.

average person care about the DJIA (or any index)? The average person in the US probably shouldn’t worry about it too much. For one, as we’ve seen over the past couple of years, it is possible for the DJIA to soar while many people are unemployed. It is simply an indication of the health of public companies trading stock.

So, let’s assume you have index funds in your 401K (these funds mirror one index or another). How much does it matter to you? It matters in that your money is in the market and it grows (or declines) as the market does. However, before obsessing over it, think about the amount you have.

If you have $5,000 in your index fund and the DJIA goes up by 1%, you made $50 on paper.

If you have $50 million in an index fund and the DJIA goes up by 1%, you made $500,000 on paper.

How important is it for you to follow the DJIA?

Do Unions Hurt Small Businesses?

Mitt Romney put out a video in which a small business owner relates his story of how a union bullied his company because his employees didn’t want to organize. Here it is:

This video raises some questions:

- Are unions better for employees of large businesses rather than small businesses?

- Do unions today help employees in any business?

- Do employees really need collective bargaining? Does it benefit them?

- Perhaps most importantly: Is it possible to align management and labor interests?

Saving the Economy (Part 1)

In the September 11, 2011 edition of the New York Times, there is an opinion piece by Harvard University professor Robert Barro titled “How to Really Save the Economy”. In it, he describes “six big steps” that will, well, save the economy. We’ll look at one a day over the coming week.

Dr. Barro’s first step is “reforming Social Security and Medicare by increasing ages of eligibility”.

Let’s say we raise the ages of eligibility for both Social Security and Medicare to 70. Financial impacts aside, doing this would effectively mean that the retirement age would de facto become 70 years of age. Which means more of people would in the “working age” pool of those eligible to be employed.

At a time when we have high unemployment (meaning more people eligible to work than there are jobs), should we increase the number of eligible workers?

You must be logged in to post a comment.