yakettyyak

Markets

How important is it for you to follow the stock market?

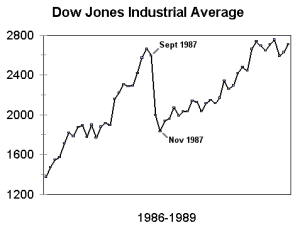

If you listen to the news on the radio or watch it on TV, you will always hear about the Dow Jones Industrial Average (DJIA) going up or down on a particular day. What does that mean?

The DJIA is an index which means that it is an attempt to put together a portfolio of stocks that reflects the stock market as a whole. There are other indices like the Russell 2000 and the S&P 500.

Why do we need indices? Well, think of it as being like a big pot of soup. In order to decide whether or not we need to add more salt, we dip in a spoon and taste it. But how do we know the place we dipped the spoon in tastes like the rest of the pot? We pretty much know this because all the ingredients in the soup are represented to some extent in the spoon. That’s what an index tries to do.

So, why should the  average person care about the DJIA (or any index)? The average person in the US probably shouldn’t worry about it too much. For one, as we’ve seen over the past couple of years, it is possible for the DJIA to soar while many people are unemployed. It is simply an indication of the health of public companies trading stock.

average person care about the DJIA (or any index)? The average person in the US probably shouldn’t worry about it too much. For one, as we’ve seen over the past couple of years, it is possible for the DJIA to soar while many people are unemployed. It is simply an indication of the health of public companies trading stock.

So, let’s assume you have index funds in your 401K (these funds mirror one index or another). How much does it matter to you? It matters in that your money is in the market and it grows (or declines) as the market does. However, before obsessing over it, think about the amount you have.

If you have $5,000 in your index fund and the DJIA goes up by 1%, you made $50 on paper.

If you have $50 million in an index fund and the DJIA goes up by 1%, you made $500,000 on paper.

How important is it for you to follow the DJIA?

You must be logged in to post a comment.